The global electric vehicle (EV) market is projected to reach a staggering $800 billion by 2027, with battery technology playing a pivotal role in this transformation. As we delve into the realm of ev battery companies, it becomes essential to understand their unique market attributes and how they influence investment decisions.

Market Characteristics of EV Battery Companies

EV battery companies are characterized by rapid innovation, fluctuating demand, and significant capital requirements. These firms operate within a highly competitive landscape where technological advancements can quickly alter market dynamics. Additionally, the increasing emphasis on sustainability has led to heightened scrutiny regarding environmental impacts and supply chain transparency. When assessing these companies for investment opportunities, one must consider factors such as production scalability and regulatory compliance—elements that significantly contribute to overall Investment Risk Assessment.

The Intersection of Battery Industry News and Investment Risk Assessment

Staying abreast of battery industry news is crucial for understanding potential risks associated with investments in EV battery companies. Recent developments—including breakthroughs in solid-state batteries or shifts in government policies—can dramatically affect company valuations and operational viability. Furthermore, fluctuations in raw material prices often make headlines; these changes directly impact cost structures and profit margins within the sector. Therefore, investors should closely monitor industry trends as part of their comprehensive risk assessment strategy.

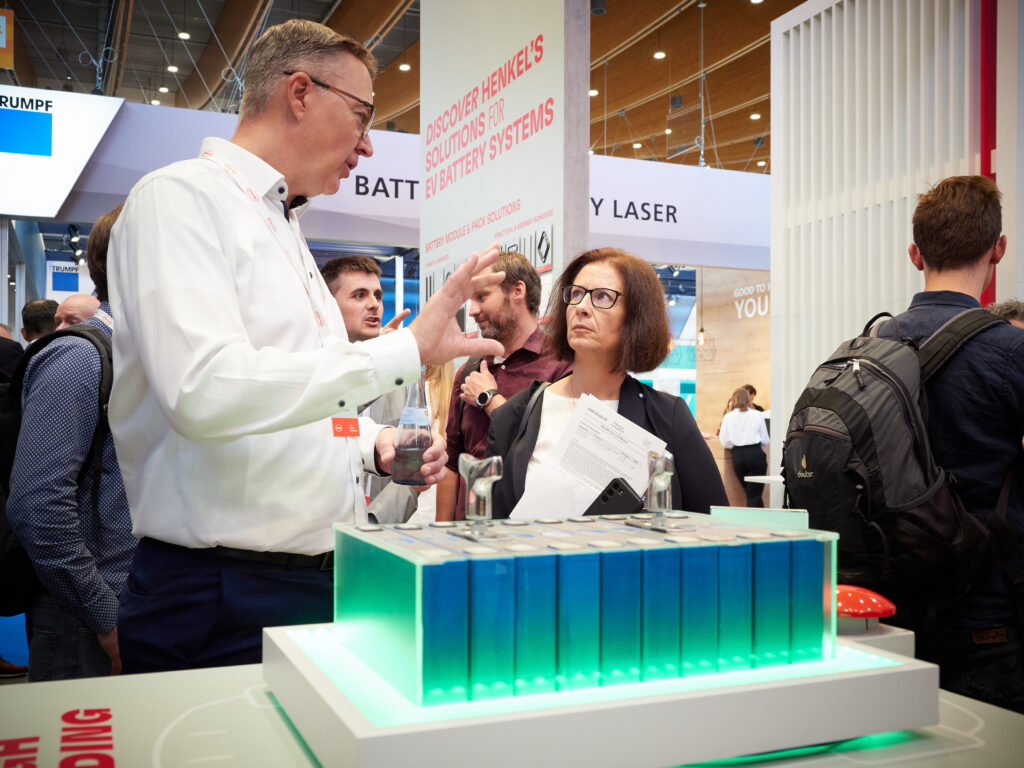

The Battery Show: A Key Indicator for Investment Risk Assessment

- Networking Opportunities: The Battery Show serves as an invaluable platform for connecting with key stakeholders across the supply chain—from manufacturers to end-users—which can provide insights into emerging trends.

- Technological Innovations: Exhibitors showcase cutting-edge technologies that could redefine performance benchmarks; understanding these innovations helps assess future competitiveness.

- Sustainability Focus: Many discussions at The Battery Show center around sustainable practices; evaluating how well a company aligns with green initiatives can mitigate long-term risks.

- Pivotal Insights from Experts: Panels featuring industry leaders offer forecasts about market direction which are critical when considering investment timing.

- Diverse Perspectives: Engaging with various players provides a holistic view of challenges faced by different segments within the industry—essential information for thorough risk evaluation.

A Concluding Perspective on EV Battery Companies’ Investment Risks

The landscape surrounding EV battery companies presents both exciting opportunities and considerable risks from an investment perspective. By thoroughly analyzing market characteristics alongside current events within the battery industry—and leveraging insights gained from platforms like The Battery Show—we can better navigate potential pitfalls while identifying promising avenues for growth. Ultimately, informed decision-making will be paramount as we continue to witness this dynamic sector evolve rapidly over time.